19+ mortgage vs income

Check Your Official Eligibility Today. Keep in mind that your total housing payment.

Is Gross Or Net Income Better For Calculating Mortgage Affordability Total Mortgage

Ad Updated FHA Loan Requirements for 2023.

. Conventional wisdom has always suggested you need to have at least 20 of. Compare Apply Directly Online. Web Generally speaking the larger your down payment the less you pay in overall interest for the home.

How much house you can afford is also. Lenders want to make sure these expenses dont exceed 36 of your monthly. Take the First Step Towards Your Dream Home See If You Qualify.

Web Mortgage-to-income ratio is calculated by dividing your expected mortgage payment by your monthly gross income. Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households. Web Back-end DTI includes all of your debt payments in addition to the proposed mortgage payment.

Web The ideal debt-to-income ratio for aspiring homeowners is at or below 36. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. This estimate is for an individual without other expenses.

Compare Offers Side by Side with LendingTree. Web A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. Ad Highest Satisfaction For Home Financing Origination.

When it comes to calculating affordability your income debts and down payment are primary factors. Lowest Home Financing Rates Compared Reviewed. Take Advantage And Lock In A Great Rate.

Compare Your Best Mortgage Loans View Rates. Flexible Terms and Great Service at Mascoma Bank. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Web Key Takeaways. Use NerdWallet Reviews To Research Lenders. Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your.

Web Say youre buying a 250000 home and are making a 20 down payment. Ad Top Home Loans. Since the 1960s however the.

Use NerdWallet Reviews To Research Lenders. Ad Easier Qualification And Low Rates With Government Backed Security. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Borrowers with low debt-to. Web The ratios mentioned above with regard to your DTI are often summarized at the 2836 rule meaning your mortgage payment shouldnt be more than 28 of your. Apply Easily Get Pre Approved In 24hrs.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web In the 1960s the price-to-income ratio was 2 meaning that two years of household income was enough to purchase a house. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Lets also assume youre getting a 30-year fixed mortgage at 37 interest. Take Advantage And Lock In A Great Rate. Web Factors that impact affordability.

Ad Learn About Todays 15-Year Home Mortgage Rates Through Mascoma Bank. Web But mortgage lenders dont think that way. The 2836 rule of thumb for mortgages is a guide for how much house you can comfortably afford.

And thats because income is only one small part of the mortgage equation. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Apply Today Enjoy Great Terms.

When all things are considered like your debt. The 2836 DTI ratio is based on gross income. Ad Get the Right Housing Loan for Your Needs.

Of course the lower your debt-to-income ratio the better.

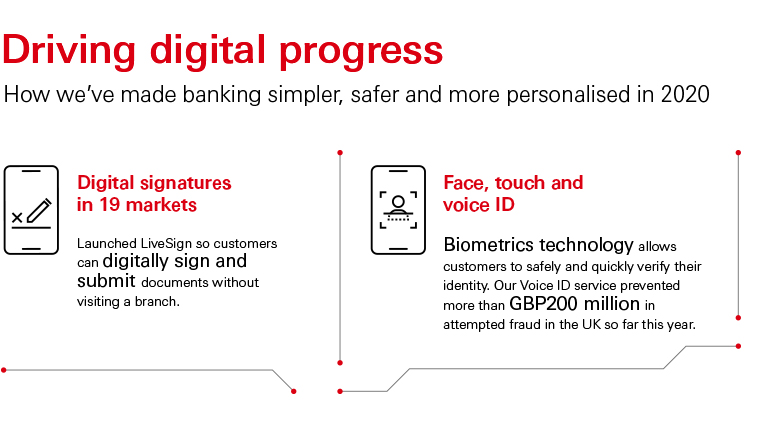

How Banking Will Change After Covid 19 Insight Hsbc Holdings Plc

How Much Of My Income Should Go Towards A Mortgage Payment

Why Soon To Rise Mortgage Rates Are A Good Thing

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

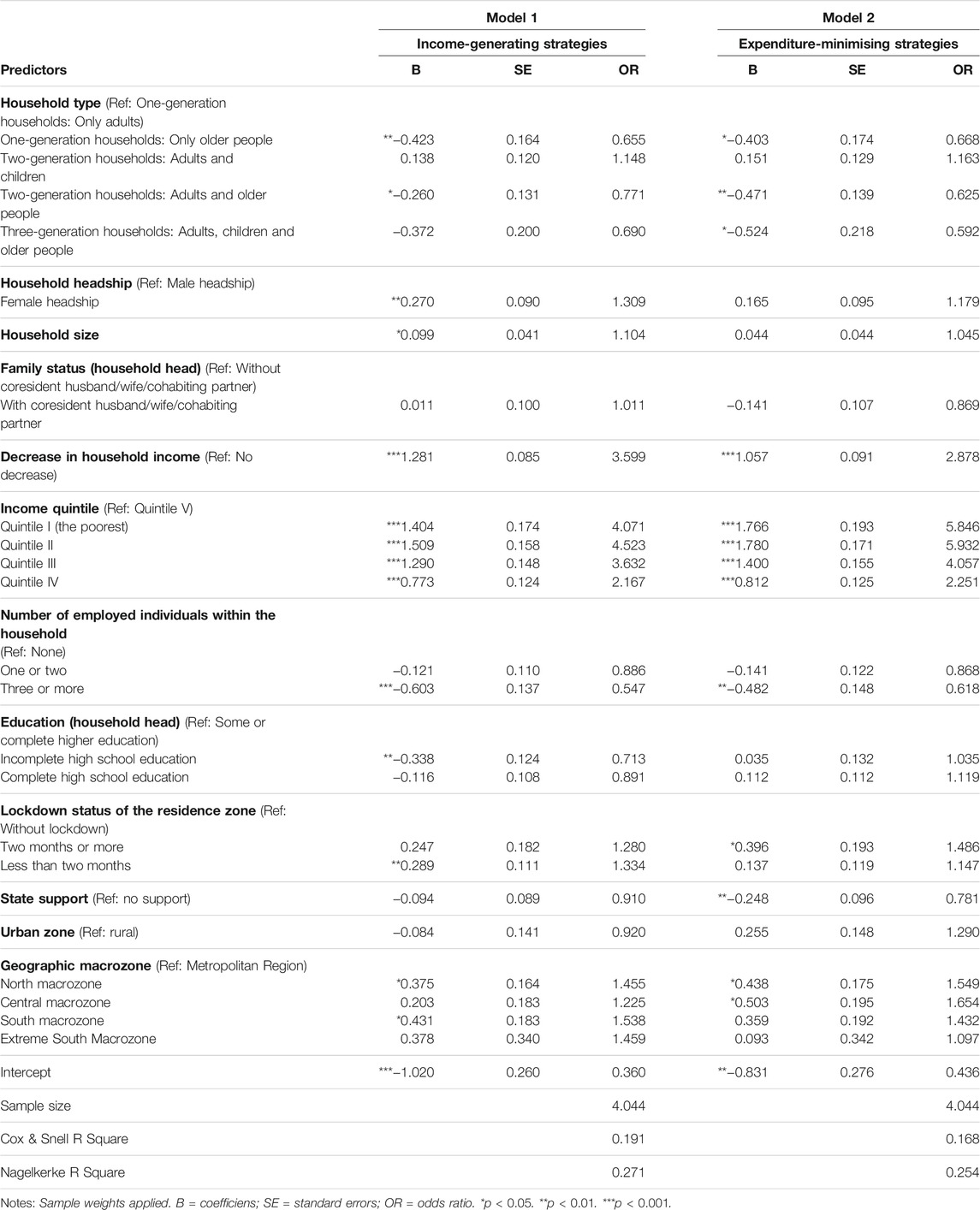

Frontiers Household Coping Strategies During The Covid 19 Pandemic In Chile

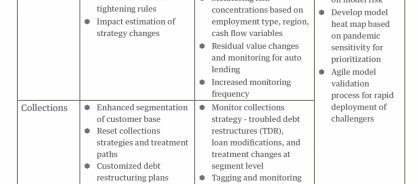

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

Mortgage Payment Relief During Covid 19 Crisis Best Best Krieger

Percentage Of Income For Mortgage Rocket Mortgage

Impacts Of The Covid 19 Pandemic On Business Operations

Impact And Recommendations For Credit Risk Management

5 Mortgage Rate Looms Ahead Real Estate Tech Company Secures Millions And More Mckissock Learning

Impacts Of The Covid 19 Pandemic On Business Operations

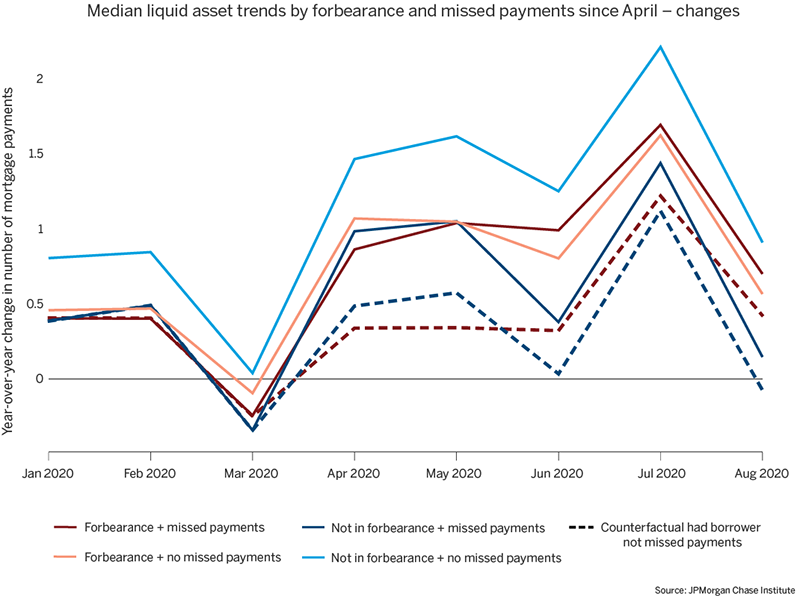

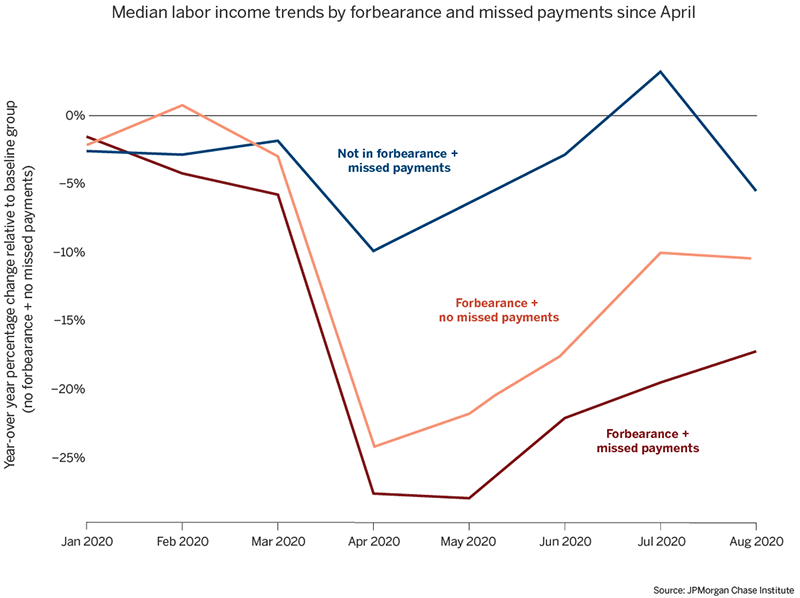

Did Mortgage Forbearance Reach The Right Homeowners

Mortgages In Poland Hamilton May

Leo Gocemen Vice President Of Mortgage Lending Crosscountry Mortgage Cleveland Linkedin

Did Mortgage Forbearance Reach The Right Homeowners